Are you a real estate agent that has sold a home in New Jersey in the last six years?

Were deductions made from your pay by the real estate agency you worked for?

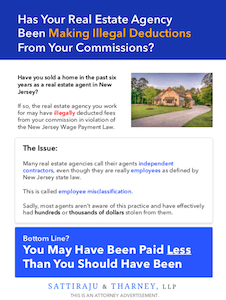

If you answered yes to both of these questions, you may have been misclassified as an employee and underpaid.

Misclassification of employees as independent contractors is a serious problem. Many businesses in New Jersey have chosen to misclassify their employees to reduce operating expenses and shift them to their workers.

The New Jersey Wages Payment Law offers protections for employees who have been misclassified and underpaid. The law allows affected individuals to file a claim within six year for unpaid wages.

Download Our Free Guide

Are you a real estate agent in the state of New Jersey? Find out the specific signs that indicate you may have been misclassified, as well as what the ABC Rule is.

Download Now

Are You an Employee or Independent Contractor?

New Jersey courts look at several factors to determine whether a worker is truly an independent contractor or an employee.

Some key issues include:

- Whether the worker is free of the realtor’s direction and control. If the worker is an independent contractor, then the realtor should be mostly focused on whether the house sells and not much else.

- Whether the worker provides services outside the employer’s usual course or places of business. If not, they look like an employee.

- Whether the worker has an independent business, trade, or occupation. If you do, then you are probably not an employee and should not be treated like one.

If a real estate broker tells an agent when and where to work, and if the broker instructs the agent what to say when showing a home, then the worker should be classified as an employee and not an independent contractor. This is also true if the broker prohibits a real estate agent from working with other brokers.

Don’t let your real estate agency steal your commission.

Call us for a free consultation:

609-799-1266

Common Questions About Misclassification

What Are Signs I’ve Been Misclassified and Underpaid?

If you were a real estate agent at any point in the last six years and made a sale, it is very likely you have had money taken out of your commission statements illegally. All you need to do is look at your commission statement. If you see deductions such as Marketing Fee or Office Fee, you’ve very likely been underpaid.

Why Do Real Estate Agencies Misclassify Agents?

By wrongfully deducting expenses, agencies pass their operating expenses onto agents — saving them thousands of dollars each year.

What Can I Do If I was Misclassified?

You should consult with an attorney experienced in the area of wage and hour litigation. Real estate agents may be entitled to recoup deductions illegally taken from their commission statements

How Long Do I Have To File a Claim?

Under the New Jersey Wages Payment Law, you have six years to file a claim for unpaid wages.